Why Getting Prequalified for a Loan is So Important

While determining whether to buy a home you’ve probably heard the word “prequalify” floating around. But why? Getting prequalified for a mortgage before making an offer on a home is our #1 recommendation as lenders. It helps us, help you get the best home in your price range!

What is Prequalification?

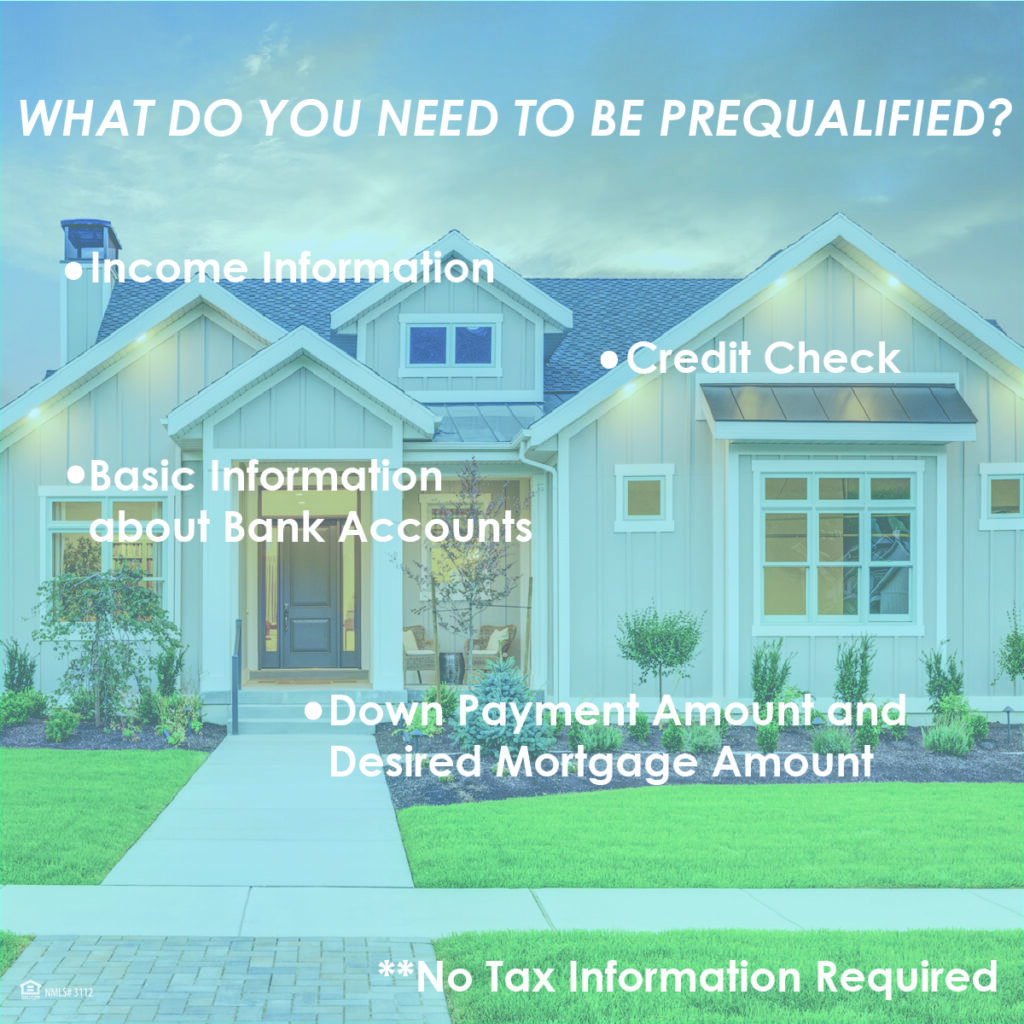

Prequalification tells you how much you would be qualified to borrow from a mortgage lender. There are certain factors that will help the loan officer determine your eligibility. Going through the prequalification process will help you figure out whether you’re financially ready to become a homeowner.

These are the benefits of getting prequalified for a mortgage:

- Determine if you are financially ready to buy a home.

- Understand your price range when looking for a home.

- Confidently make an offer you can afford.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals. It gives you a basic idea on how to get started when house hunting.

Getting prequalified is simple. Before you start the house hunt, get prequalified with a loan officer. Contact us at First Colony Mortgage today and let us help you walk into a smooth home-buying experience.